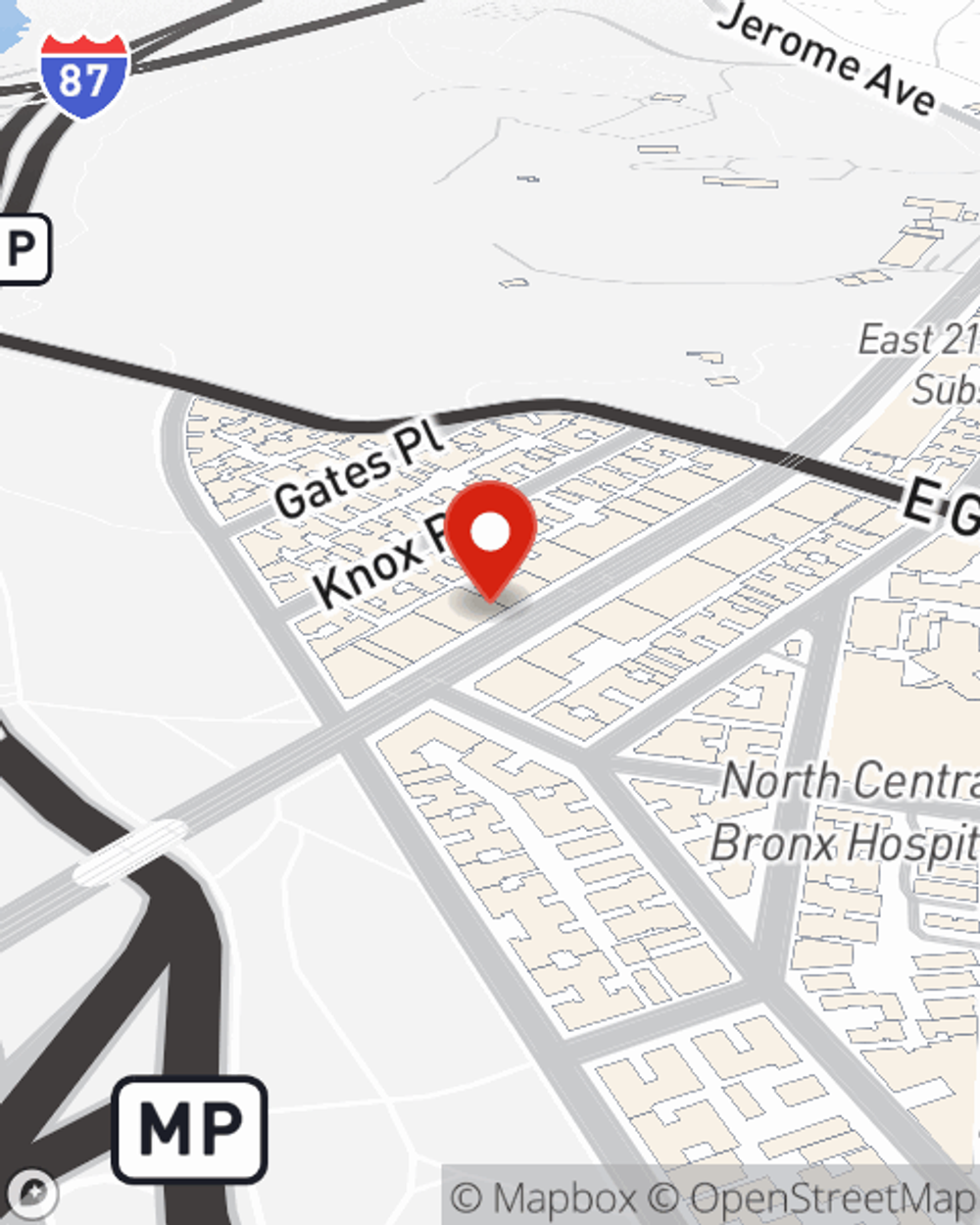

Business Insurance in and around Bronx

One of the top small business insurance companies in Bronx, and beyond.

Cover all the bases for your small business

- Bronx

- Brooklyn

- Manhattan

- Queens

- Staten Island

- Nassau County

- New Jersey

- Suffolk County

- Connecticut

- Westchester County

- Yonkers

- Mount Vernon

- New Rochelle

- Eastchester

- Bronxville

- White Plains

- Stamford

- Darien

- Greenwich

- Bergen County

- Harlem

- Washington Heights

State Farm Understands Small Businesses.

Small business owners like you wear a lot of hats. From HR supervisor to tech support, you do everything you can each day to make your business a success. Are you a hair stylist, a fence contractor or a pharmacist? Do you own an advertising agency, a tailoring service or a cosmetic store? Whatever you do, State Farm may have small business insurance to cover it.

One of the top small business insurance companies in Bronx, and beyond.

Cover all the bases for your small business

Strictly Business With State Farm

Your business is unique and faces specific challenges. Whether you are growing a bagel shop or a deli, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Marclan Pinnock can help with extra liability coverage as well as commercial auto insurance.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Marclan Pinnock's team to discuss the options specifically available to you!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Marclan Pinnock

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.